Wind power along with solar is seen as one of the most important elements of the power transition away from fossil fuels. However, despite promises by half of the world’s nation states, there are many challenges still to overcome.

At COP 28 in Dubai in December 2023, 120 countries signed a pledge to triple energy from renewables. This follows on from the G20 meeting in Delhi in September when leaders of the world’s major economies backed a tripling of global renewable energy capacity by 2030 away from fossil fuels for energy production.

All of that would seem to auger well for the wind industry but there are many factors that must be addressed and there have also been several setbacks in wind power’s onward march. Notable recent events include Siemens Gamesa discontinuing its plans to build offshore turbine blades in Virginia, US and Danish renewable energy developer Ørsted’s pull out from offshore wind projects in New Jersey citing rising interest rate costs and supply chain issues.

Subsidies for wind, and offshore wind in particular, are beginning to be withdrawn as the sector starts to mature. There is a notable lack of standardisation as projects begin in new areas of the globe. Countries naturally wish there to be a high degree of local content so there is a constant reinventing of the wheel which increases costs when common standards, if adopted, could actually be driving costs lower.

Further challenges lie in the timescale with planning, securing investment, lack of component availability, construction time, transport and logistics, grid integration and scaling all making for a complex situation for wind farm developers. The time from early planning to coming on stream can be as long as ten years.

Currently, developments in offshore wind means that new capacity is being added at around 10GW per year with plans to scale up to somewhere between 50 and 100GW annually at some future point. In its 2023 Energy Transition Outlook (ETO), DNV examined some of the issues and highlighted the challenge of accurate forecasting in a period when pandemics, war and rising costs have clouded the picture.

Making the case for investment in a market set for growth

In its ETO report, DNV makes the case for looking beyond current problems. India, China and some others may be backtracking a little on transitioning, but elsewhere a different picture is emerging.

The Fit for 55 and RePowerEU policies in the EU and the Inflation Reduction Act in the US are already demonstrating powerfully that decarbonization policies can work on a grand scale. In DNV’s forecast, non-fossil sources constitute 52% of the energy mix in 2050, a sharp increase from the 20% they represent today. Included in that forecast is a 13-fold increase in solar and wind electricity production.

The report and the developments at COP 28, even though the latter still has many loopholes to close, should bring some reassurance to investors that the market for offshore wind will soon take off.

With renewed levels of investment comes the need to find means of scaling up, looking into sourcing, recycling of raw materials, the supply chain processes, and designing structures for fast manufacture and installation. More intelligent use of assets and greater return on investment (ROI) can be aided by digitalization – looking at the possible outcomes under different scenarios using digital twins and other software tools to gain insight.

Comprehensive software

Sesam software has more than 50 years of use in designing steel and concrete structures for the ocean environment, beginning with ships, it evolved into oil and gas applications, and more recently has become a mature product for offshore wind energy, including floating. The software enables structural engineering designers to model, analyse and assess compliance to standards in one package. Furthermore, Sesam is used throughout the lifecycle, from concept design, through to construction, operations and decommissioning.

Bladed, youthful at 40 years as a software product, is the defacto standard software tool for designing modern wind turbine systems. It is an industry standard that blends structural models with aerodynamic models with sub-system models to design for optimal whole system performance. Certainly, the presence of large rotating components attached to a stationary, but flexible, structure makes for a challenging dynamic modelling problem, unavailable in off-the-shelf simulation tools. Bladed is effectively a virtual wind turbine in a single computational model that provides an accurate and well-validated description of the turbine’s behaviour.

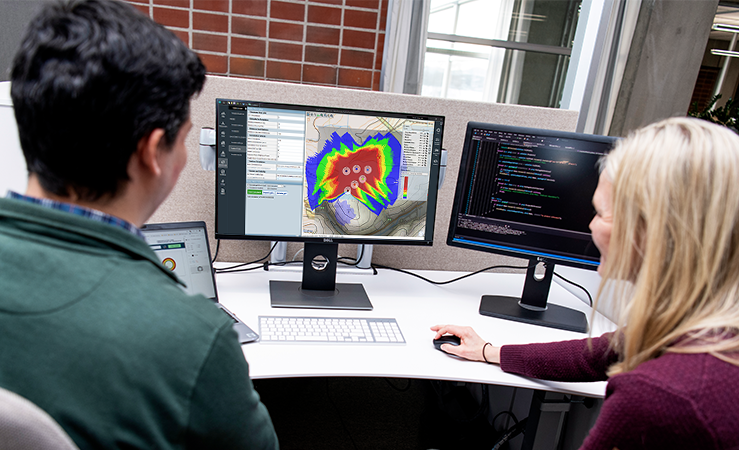

WindFarmer and SolarFarmer are software tools for gaining confidence in designing and assessing wind and solar farms respectively. Both come with industry-leading API and automation capabilities built to accelerate pre-construction workflows. Additionally, they are backed by the world’s most extensive offshore wind and large-scale solar energy yield validation datasets. The software tools also offer reassurance to investors and provide project developers with a consistent methodology from concept to financing.

Experience shows that digitalization brings a competitive edge through modelling productivity gains at every phase in designing, financing and operating wind farms. Automated workflows enabled by digitalization brings scale by the ability to run tens of thousands of permutations at the same time. In future developers in the offshore wind sector will be relying as much on software engineering as mechanical engineering and design.

Digitalization proves its worth

When it comes to the digital transition paradigm, there are plenty of examples of the benefits that the software imparts. As an example, one customer with a design team of five persons using the WindFarmer software is making around 200,000 energy yield API calls per month. Comparing the productivity, by the number of tasks that those team members could have done as individuals running desktop tasks as opposed to automated ones, that’s already more than an order of magnitude increase in the amount of throughput achieved.

Companies adopting automated workflows could conceivably be operating at about 10 times the efficiency per analyst or engineer. In most cases the uplift in productivity enables customers to analyse more options or more business cases and achieve a level of optimization that means that their solution can often improve overall revenue, typically enhancing energy production by 1-2%. Even a relatively low levels of just 1 or 2% improvement translates into a significant ROI over a 20- year life span of a turbine or wind farm.

Improved performance at that level helps to build trust and the bankability of projects seeking investment. Importantly, the examples are not isolated cases. DNV has already used WindFarmer in the development of some 340GW of wind farm capacity and can count a combined 900 years of wind farm operation and 4,000 turbine years where data from real time operations can be verified and the software evolved and adjusted accordingly. With such a robust data set a lot of trust can be placed in the outputs from the software for future projects.

Trust and relationship depth between partnering organizations will be increasingly important for success in a fiercely competitive market. With software such as Sesam reducing design time for all wind farm types and delivering reductions in development costs, Bladed used for design of the new generation of 20MW+ turbines as well as smaller variants, and WindFarmer giving confidence in the financial performance of offshore wind farm projects and doubling the projects delivered per analyst – all of the necessary digitalization tools are readily available from DNV.