What is the EU ETS?

The EU ETS is an emissions cap-and-trade system that aims to reduce greenhouse gas (GHG) emissions by setting a limit, or cap, on GHG emissions for certain sectors of the economy.

Each year, a limited number of EU Allowances (EUAs) is made available for trading in the market, and this is reduced yearly in order for the EU to meet its target of a 55% reduction in GHG emissions by 2030 relative to 1990, and net zero by 2050.

Each EUA gives companies a right to emit GHG emissions equivalent to the global warming potential of one tonne of CO2 equivalent.

The implementation timeline for shipping

The EU’s legislative bodies have adopted a revision of the EU ETS directive to include shipping from 2024.

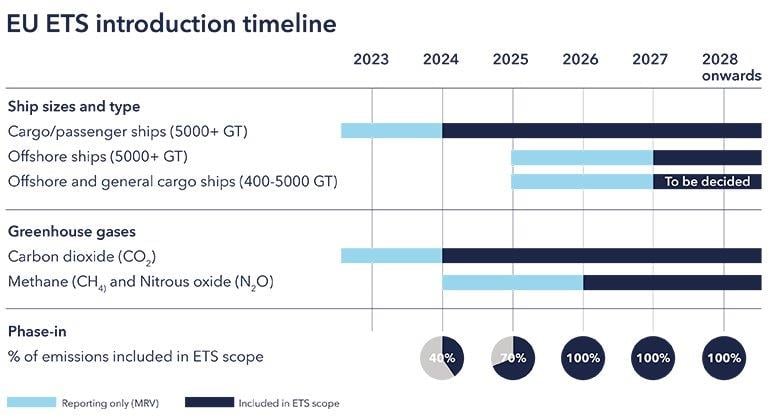

EU ETS introduction timeline

This entails a three-year phase-in period, increasing in scope from 40% of emissions in 2024 to 70% in 2025 and 100% in 2026. It applies to cargo and passenger ships above 5000 GT from 2024 and offshore ships above 5000 GT from 2027. The EU ETS will initially cover carbon dioxide emissions and be widened to include methane and nitrous oxide from 2026. Offshore ship and general cargo ships between 400 and 5000 GT will also be required to report emissions and may be included in the EU ETS at a later stage.

The scope of the EU ETS directive

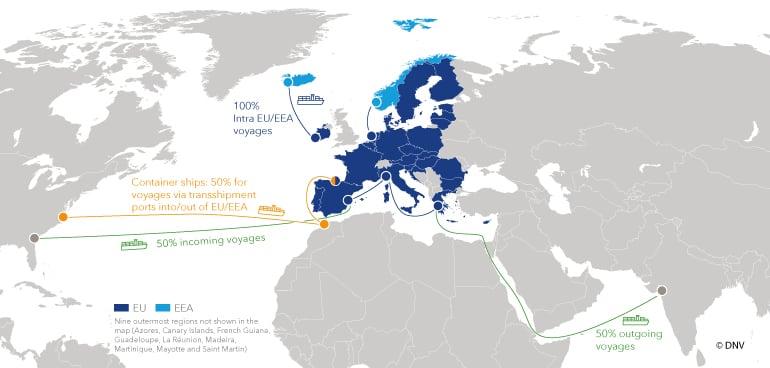

EU ETS based on percentage of emissions on voyages

(Click here to open high-resolution version in a new tab)

All 100% of emissions on voyages and port calls within the EU/EEA, and 50% of emissions on voyages into or out of the EU/EEA, are subject to the EU ETS. To avoid evasive behaviour, container ships stopping in transshipment ports outside the EU/EEA but less than 300 nm from an EU/EEA port, need to include 50% of the emissions for the voyage to that port as well, rather than only the short leg from the transshipment port. The EU will provide a list of transshipment ports.

Shipping companies with ships operating to or from ports in the EU or EEA will be required to hold sufficient EUAs for the GHG emissions from ships under their control and surrender these allowances to the authorities each year. These companies are required to monitor, report and verify the GHG emissions on an annual basis under the EU MRV regulation and this information is used to determine the allowances they need to surrender.

EU ETS cost implications for shipping

The purchasing and surrendering of emission allowances under the EU ETS can be quite costly for shipping companies, and this is likely to have implications for pricing and other terms of contractual agreements between parties across the value chain, including charterers and cargo owners.

This will necessitate a common and trusted basis of emissions performance data for voyage verification – for all parties to manage substantial tax cash flows across the value chain.

Learn about cost and settlement of allowances on tab "Settlement of allowances".

How DNV can help you with the EU ETS

Discover how you can benefit from DNV solutions by clicking the tiles below.