- Oil and gas

- Laboratories and test facilities

- Laboratories articles

- 3D printed parts could benefit oil & gas, offshore and maritime supply chains

3D printed parts could benefit oil & gas, offshore and maritime supply chains

Trust is key to unlocking additive manufacturing’s potential for your business. We look at the top benefits of, and barriers to, this technology, and how DNV can help your sector to use it to become safer, more efficient and more sustainable.

A potential revolution in design, manufacturing and distribution

Additive manufacturing (AM), a sophisticated development of 3D printing, could transform how products used in projects and operations are designed, manufactured and distributed. Through its Global Additive Manufacturing Technology Centre of Excellence in Singapore and global network of experts, DNV has broad perspectives and detailed insights into how AM can help these sectors to become safer, more efficient, and cleaner. Here are just five big reasons why we believe AM has great potential to do this. We also summarize barriers to its uptake and how our collaborations with industries, governments and academia are tackling these.

Enabling shorter lead times, less storage and reduced inventory

AM could shorten lead times for sourcing parts and reduce the need for costly storage space on platforms, rigs and vessels as digital files replace physical products needed to keep assets operational. Many operators tie up huge sums of capital in inventory that may never be used and can become obsolete over time.

The digital files store computer code that controls precision 3D printing of items. Say you need mission-critical parts to be available promptly in Brazil, but they are stored in Norway. You might invest in secondary storage in Brazil. With AM, though, digital instructions for ‘printing’ the part could go to a nearby AM company in Brazil, or directly to where it is needed. Lead times could be cut from months to days, avoiding expensive operational downtime. This model could address supply-chain issues such as costly and lengthy retooling of manufacturing equipment to fulfil urgent orders; and, the time and cost involved in sudden design changes or project cancellations. In summary, AM technologies could bring scalability, speed, customization and on-demand production with minimal or no retooling. This could assist the oil & gas, offshore and maritime industries to become leaner, more agile, and to remain competitive.

Reducing carbon footprints

AM could help the oil & gas, offshore and maritime industries decarbonize operations in the energy transition. Distributed just-in-time production close to or exactly where products are required reduces transportation needs. This in turn means less exhaust emissions, including greenhouse gases.

AM generally produces less waste than conventional methods that usually involve machining away material from a large piece of metal. In contrast, AM adds only material that is needed, and co-locating it with recycling of materials could boost local circular economies. One example could be turning used plastics and scrap metal into new feedstock powders and wires for AM.

Enabling technological innovation

AM supports innovation by enabling rapid iteration of physical objects during R&D. Combining it with modern information and communications technology lets designers, original equipment manufacturers (OEMs) and end users collaborate more efficiently from wherever they are. AM could also be better than traditional manufacturing methods for handling more complex designs, and for using unconventional and new materials. It needs less or no retooling of manufacturing equipment. It could also enable novel repair methods such as building up new layers of material on eroded areas. This could extend the safe and efficient operation of ageing assets and reduce the lifecycle cost of equipment.

Innovation can extend to the business models of supply-chain participants. Some oil and gas operators are interested in the concept of shortening supply chains by installing AM manufacturing capabilities on their own assets and sites. OEMs embracing AM could look to sell access to their designs and models rather than selling equipment and spare parts. They might consider asking end users to pay monthly subscriptions for printing high-use spare parts, or one-off downloads of digital code for manufacturing larger components.

Enabling new business models

Some OEMs see AM offering potential to recapture market share from non-OEM parts sold in ‘grey’ markets where distribution of the ‘real’ parts is absent or lengthy. OEMs could instead supply digital files securely to selected local resellers equipped with AM capability to reproduce parts legally and safely. It would reduce the cost of parts and boost availability. But who would be responsible for the part working, and for how long? Who would offer the warranty? How can an OEM remain comfortable about its name being on the part? The key issues here and in other aspects of AM are trust and assurance.

AM is already disrupting supply chains in automotive, aerospace and consumer products. It is in its infancy in the oil & gas, offshore and maritime sectors as they ponder challenges similar to those that confronted Netflix in the transition from DVDs to online streaming of video. As well as novel profit/cost models, the supply chain is grappling with intellectual property (IP) and usage rights for OEM designs, and standardization of technology interfaces.

Other potential challenges include batch inconsistency of materials for AM, variation in hardware, differing environmental and operational conditions, and regulatory change. Just as with physical stock, digital inventories will need assurance schemes including meeting cyber-security standards.

Creating trust in additive manufacturing

Faced by a wide range of challenges, trust is the key. AM needs a systematic qualification process, standards, and specialized knowledge towards qualification and certification of 3D-printed components and materials. Without standardization or guidelines, printed parts and components in oil & gas, offshore and maritime industries could raise the risk of unexpected or premature failures due to inherent variation of mechanical and metallurgical properties associated with the AM parts. Printed parts or components that were not properly identified and tested during the qualification and/or certification process could lead to unexpected functional performance behaviour. As such, non-standard practices for testing parts raise the probability of overall material costs rising compared to the traditional manufacturing route.

Through our global network of laboratories and experts, we help customers to identify how AM could add value to their businesses by addressing these barriers and enabling a safe introduction to the oil & gas, offshore and maritime industries.

Collaborating to maximize benefits of additive manufacturing

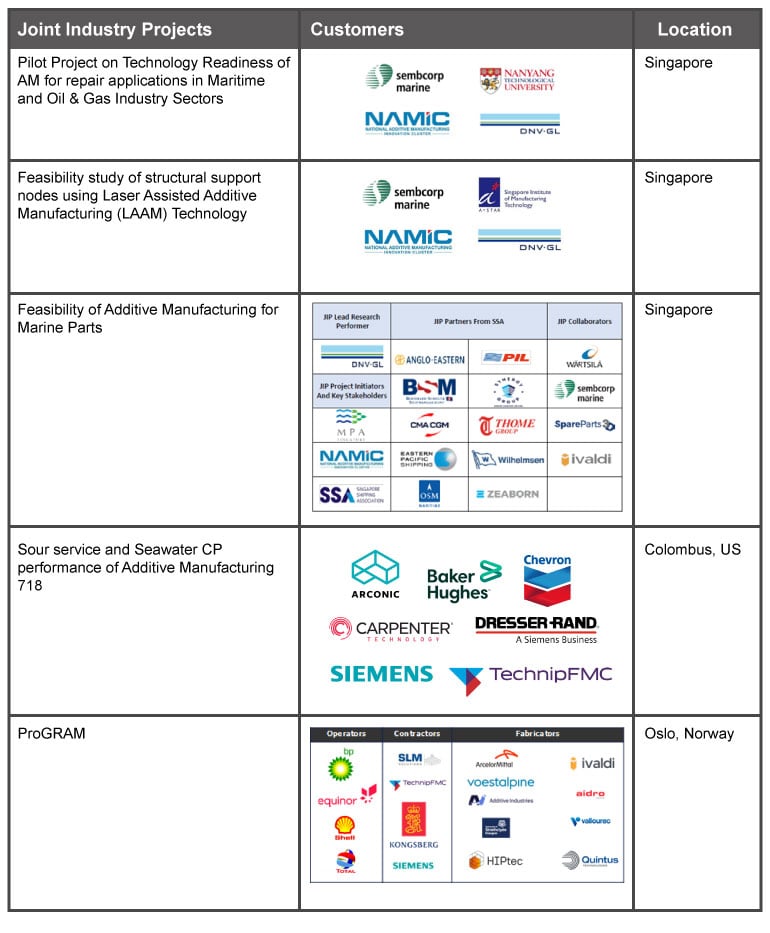

The challenge now is to get all stakeholders in the oil & gas, offshore and maritime industries talking and looking at the best ways to ensure that everyone in the sectors benefits from AM, a potential game changer. DNV has initiated several joint industry projects with customers globally in certification and qualification areas of AM for reconditioning old parts or creating on-demand new spare parts, and for fabrication of large-scale structural parts. This includes Sembcorp Marine, Maritime Port Authority, Anglo Eastern shipping, Wartsila, Baker Hughes, Carpenter, Chevron, Equinor, Shell, Total, BP, and others, to name a few.

DNV’s ongoing global joint industry projects